Free webinar reveals the #1 cash-flow strategy in any market…

Be Your Own Bank: Why Savvy Investors Are Pivoting Away from Real Estate and Stocks…and How You Can Use Private Money Lending to Generate Passive, Recurring, Double-Digit Cash Flow (Even During a Recession)

One investor to another, let me ask you…

What ONE passive investment strategy do you truly believe in right now?

What asset class are you actually excited to bet on, and feel confident will safely generate double-digit annualized cash flow in this overpriced, overheated market…and likely recession?

Do you have one in mind? If not, let’s walk through the options together.

Are you confident in real estate for cash flow?

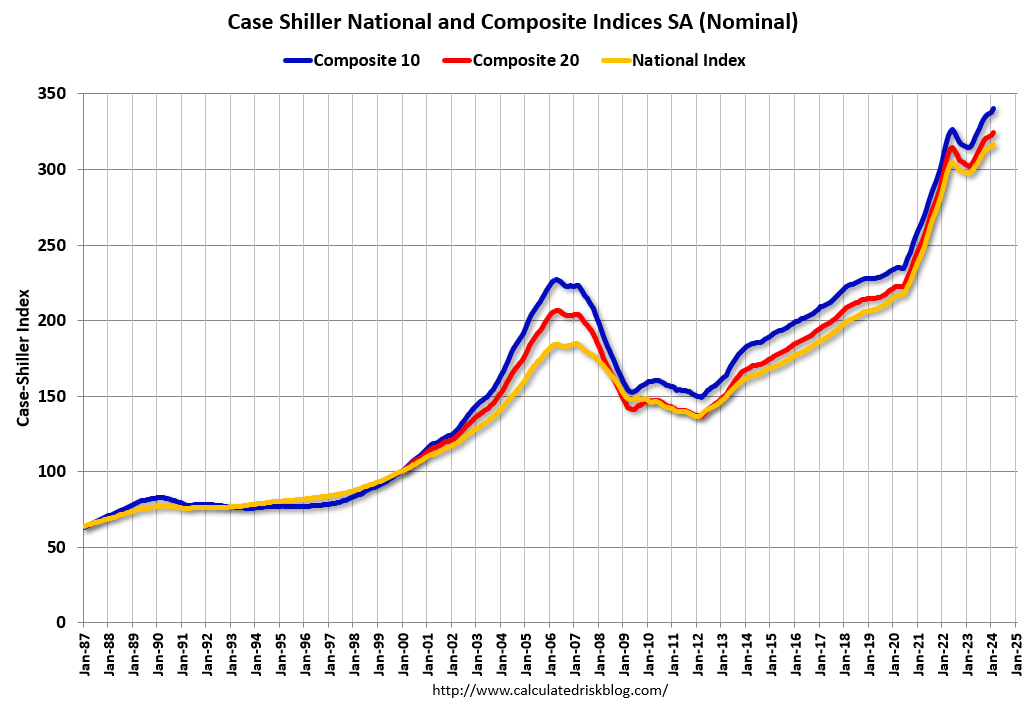

Honestly, I don’t see how you could be. We’re at the absolute top of the market cycle right now — single-family homes have literally NEVER been more expensive to buy.

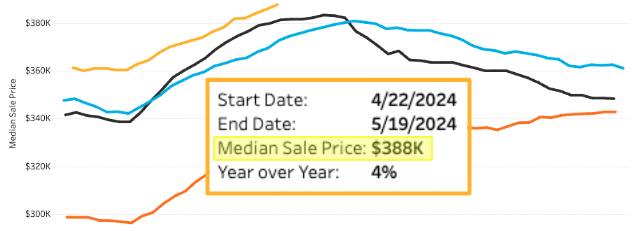

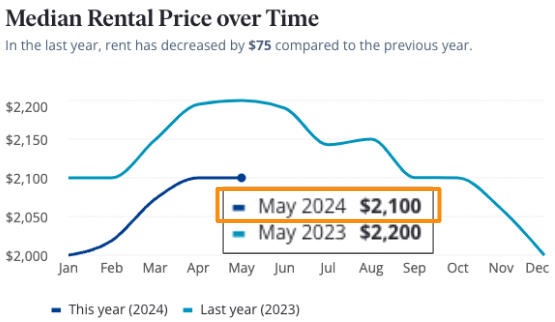

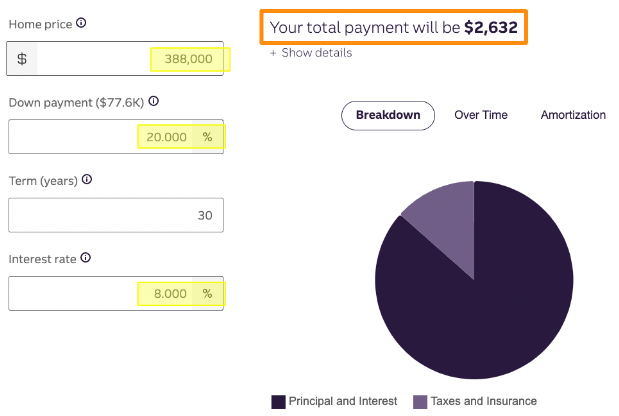

And good luck getting a newly-purchased rental to cash flow at these ~8% mortgage rates… especially when rent growth is flat nationally, and falling in many metros and sub-markets!

Compare that $2,100 median rent to the mortgage payment alone on the median home ($388,000)...and you get -$532 per month in NEGATIVE cash flow. In other words, you’ll lose $6,400 per year for the privilege of being a landlord on that property.

Wall Street’s real estate offerings aren’t faring much better this year. In fact, they’ve taken a nosedive.

Listed REITs — public Real Estate Investment Trusts — are big real estate portfolios that you can buy shares in (i.e. own equity) like you would a publicly-traded company.

But they’re getting crushed; they’re down -9.1% in just the first 4 months of the year (see below). That’s -27.3% annualized.

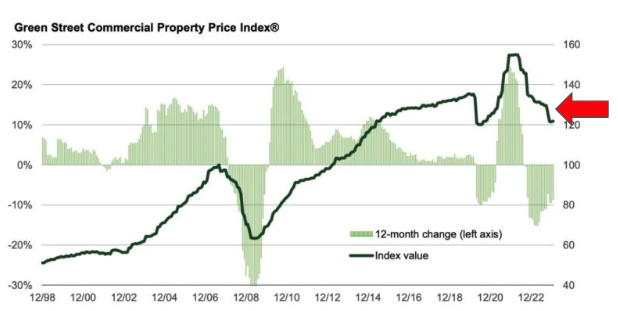

And we’ve ALL heard about the nightmare in commercial real estate, where values have fallen 28% from their high in 2021.

Even worse, those properties STILL aren’t at fair market value. Commercial research firm Green Street estimated earlier this year that appraised values may need to drop another 10% to reach fair valuations.

That would take them down near -40%.

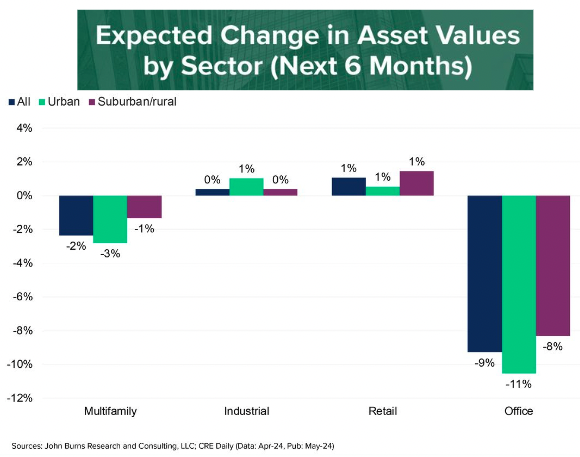

Commercial real estate investors agree, especially in multifamily and office.

Investors expect multifamily values in the next 6 months to fall another 1-3%, and office another 8-11%. And these are investors, who often err on the side of optimism.

The point is: it’s highly unlikely we’re at the bottom of this commercial correction, where it might make sense to get in and pick up some distressed deals (IF you even had access to them).

OK, well what about stocks?

Yeah, right. The S&P 500 set a new all-time high in January, then eclipsed 5,000 in February, and currently sits at its highest mark ever.

The one thing I’m sure of is that ANY market at an ALL-TIME high has more downside risk than upside potential.

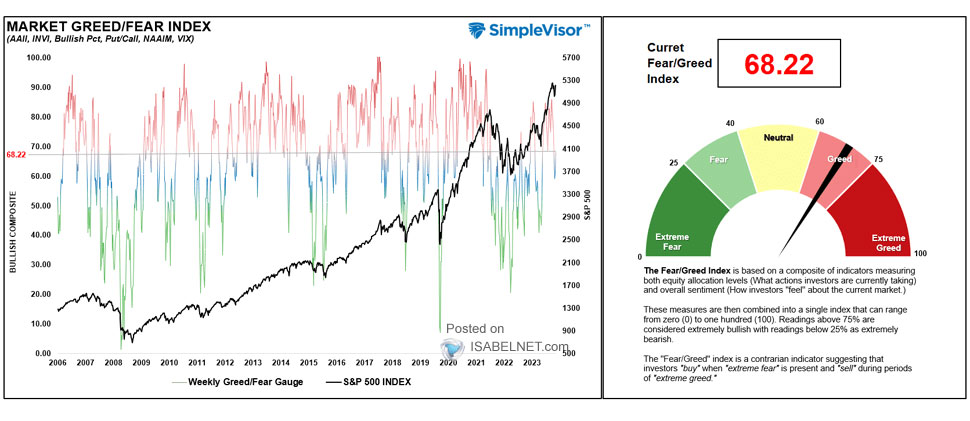

In fact, the Greed/Fear Index has consistently been in “greed” territory for over a year now.

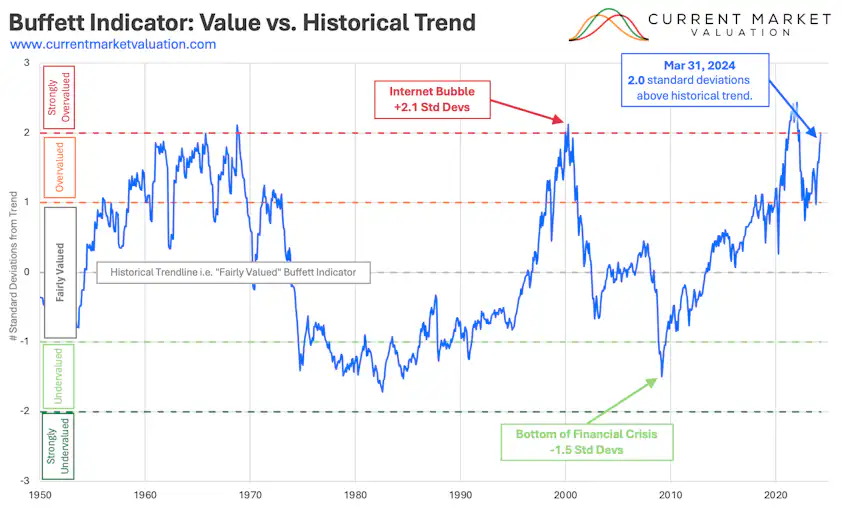

With all that greed, it’s no surprise that guys like Warren Buffett think the stock market is “strongly overvalued”.

According to Warren’s own indicator, we’re currently 2 standard deviations above the historical trendline — i.e. a “fairly valued” market. (That’s right where we were before the dot com crash in 2001.)

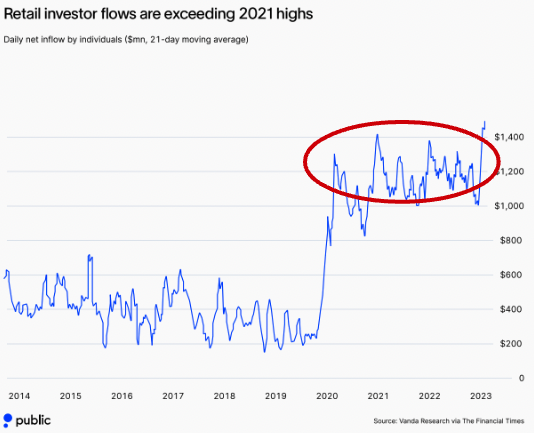

And there’s more “dumb money” piling into stocks every day. Retail investors (regular Joes and Janes) have thrown another $1B+ into the stock market EVERY SINGLE DAY for the last 4+ years.

Does now seem like the time jump on THAT bandwagon?

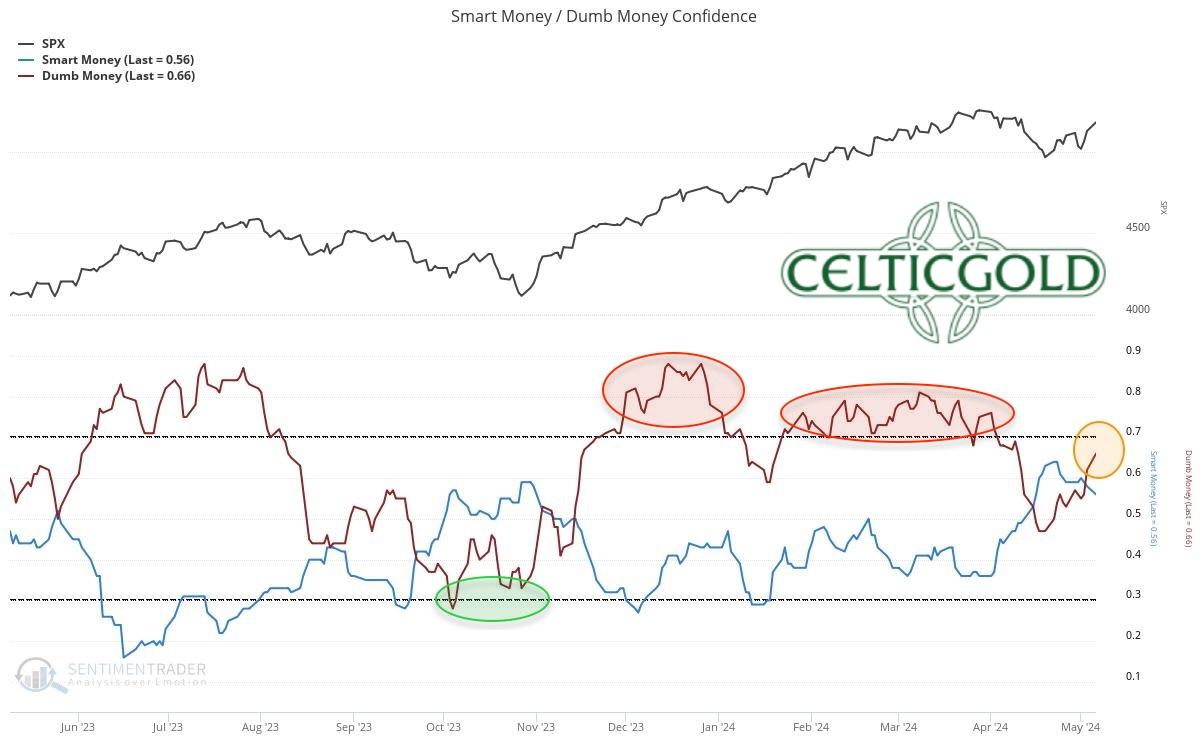

See, when “dumb money” piles in, “smart money” (i.e. professional investors) generally heads for the exits. And vice versa. The two tend to have an inverse correlation.

Professional investors see all that retail-investor FOMO driving prices way above intrinsic value — and into what many are calling “pre-crash” territory — and they wisely reduce their exposure.

The question is: are YOU smart money or dumb money?

How about other asset classes like precious metals? Or oil and gas? Or crypto?

Look, if you actually understand those asset classes, more power to you. I don’t.

I don’t even want to, because I can’t control the outcome…AND I don’t know who might be pulling the strings behind the scenes (think Wall Street and politicians).

Are there still deals out there in the asset classes we’ve covered here?

Of course. There is ALWAYS a deal out there…in any market…at any moment.

But right now, those deals are needles buried in haystacks of risk. Wouldn’t it be better just to find a haystack where the needles come to you?

So the question remains: what is that haystack? What is the best cash-flow investment strategy that maximizes your “effort-to-return ratio” given these uncertain market conditions?

See, that term “effort-to-return ratio” is key.

Every investor understands the concept on some level. They may not not have a fancy phrase for it like “effort-to-return,” but intuitively they understand…

You want to do the least amount of work (effort) while making the most money (return).

Of course, it’s easier said than done. The real trick is finding a vehicle that actually checks those boxes..an investment that generates solid, double-digit returns in the most passive way possible, with maximum security and control.

My favorite such vehicle — in an up OR a down market — is private money lending.

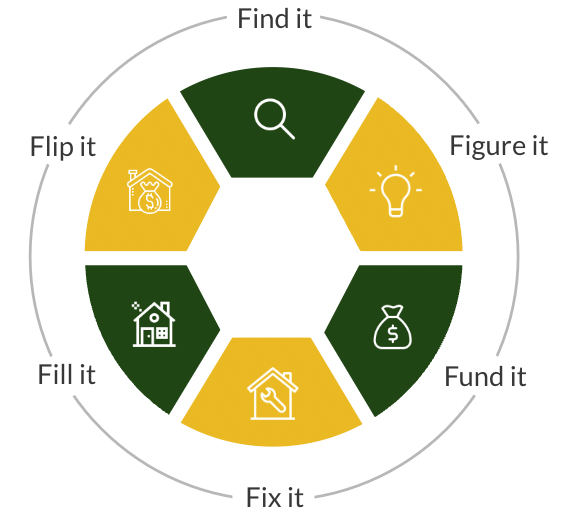

Here’s my rationale. See, there are 6 “Fs” in real estate investing:

In every real estate transaction…

Someone has to FIND the deal.

Someone has to FIGURE it by doing due diligence and running the numbers.

Someone has to FUND it, either with their own cash or with a private loan.

Someone has to FIX it up to make it sellable or rentable.

Someone has to FILL it with a renter (assuming they’re buying to hold, or ultimately flipping it as a turnkey rental to a landlord buyer).

Someone has to FLIP it to an end-buyer or no one makes any money.

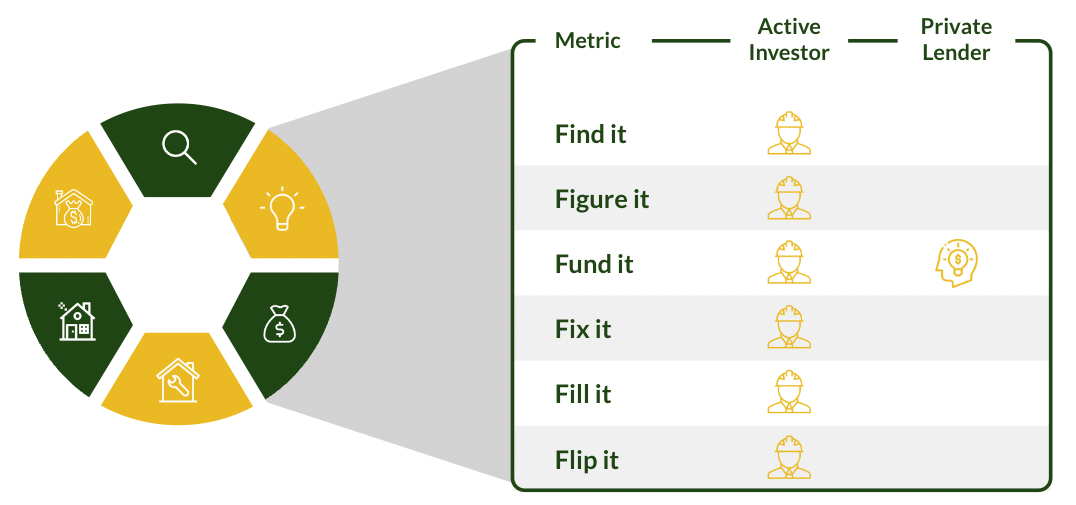

If you’re an ACTIVE investor, i.e. a flipper, you have to do all 6. You literally make no money if you skip even one of the steps (with the possible exception of “filling it”).

Private lenders, on the other hand, only do ONE. They just have to FUND it, and then wait for the checks to roll in.

So what is private money lending? And what’s my first rule of thumb for evaluating deals?

Private (aka hard money) lending is simply another way of deploying capital in real estate. It involves making high-interest, short-term loans to house flippers…usually secured by the property they’re flipping.

Here’s a stripped-down example:

Let’s say you’re sitting on some cash and you meet a fix-and-flip investor at a local REI meeting. This flipper is under contract to buy a house for $85,000 that needs $15,000 in rehab ($100,000 total) and plans to resell it for $150,000 and make a profit.

But the flipper (also called an investor-operator) doesn’t have the $100,000 cash needed to get the deal done, and a traditional bank won’t help. That’s where you come in.

You, the private lender (sometimes called the hard money lender), loan 80-100% of the capital needed ($80,000-100,000) and you get a nice return for doing so.

The flipper eagerly takes the loan in exchange for the opportunity to flip the house and get the end profit. You get paid origination fees upfront, interest along the way, and when the flipper resells the house, you get back the original loan amount (called the principal).

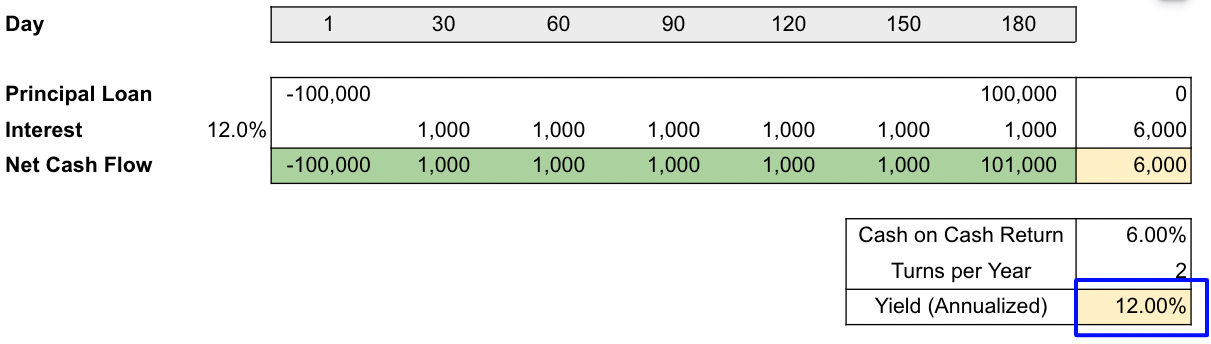

Here’s how that deal would look on a spreadsheet if your loan was out for 6 months:

On Day 1, you loan $100,000 and the flipper agrees to pay you a 12% annual interest rate.

12% of $100,000 is, of course, $12,000, which is paid in equal monthly installments ($1,000) over the course of 12 months.

On Day 30, the flipper makes his first $1,000 interest payment, then again on Day 60, Day 90, and so on.

Then, on Day 180, he resells the property and repays the original $100,000 you loaned him.

Since he repaid the loan in 6 months, you made $6,000 in interest, for a 6% Cash-on-Cash return.

However, because you can make that same loan twice in the same year (each 6 months long) your annualized return is 6% x 2 = 12%.

Now, that’s a simplified example that doesn’t include origination fees, due diligence fees, payoff fees, etc, all of which make the returns even better. But hopefully you get what I’m driving at: a private lending deal can be modeled on just 4 lines in a spreadsheet. It’s one of the simplest, most predictable ways to make double digit returns with very little ongoing effort…and the built-in risk mitigation that comes with a hard asset.

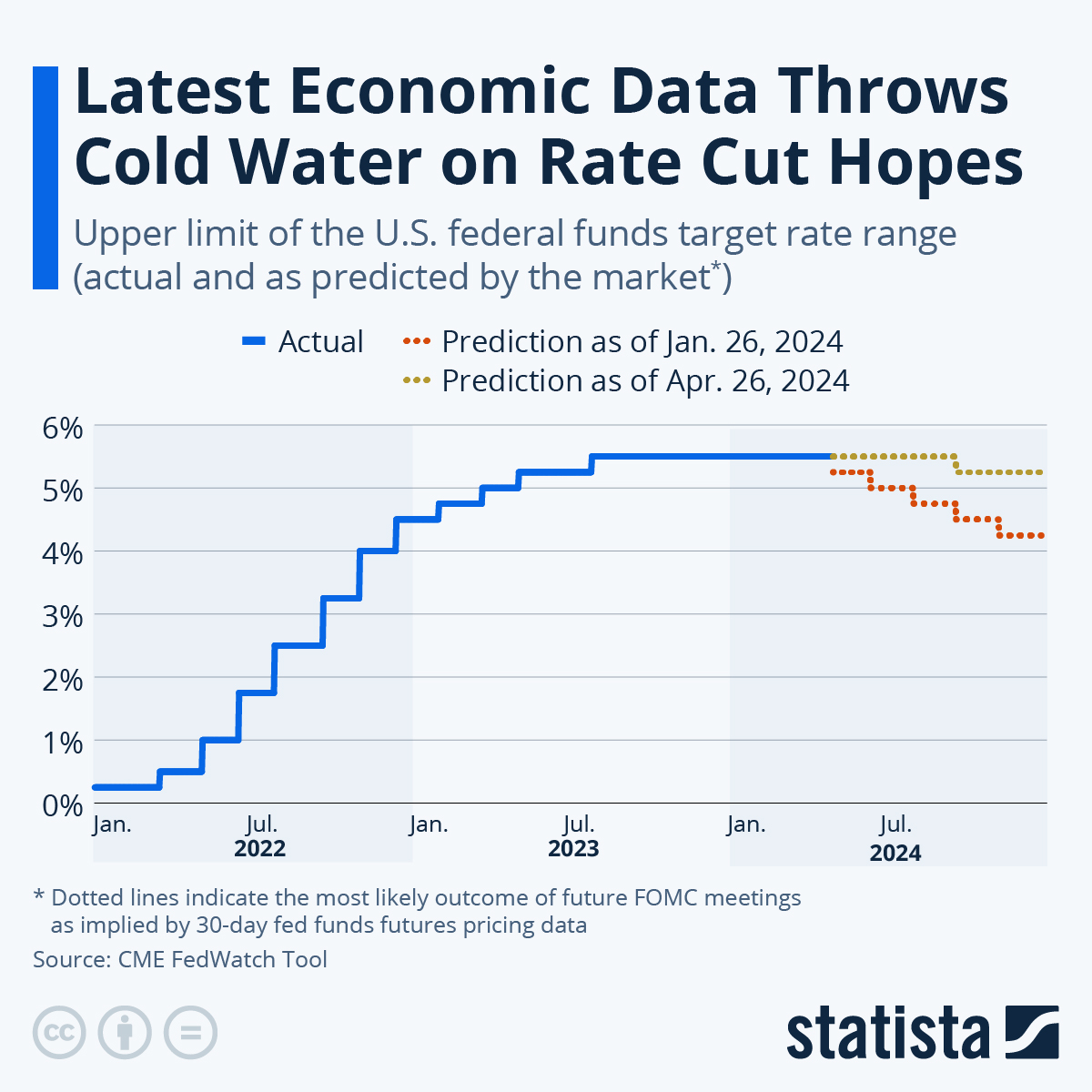

Look, I think we can ALL agree that it’s unlikely we’ll see much appreciation in ANY asset class with these “higher for longer” interest rates.

But here’s the good news: the higher Fed Funds rate has significantly helped the ONE investment strategy that’s done more for my net worth than any other — private lending.

Hard-money interest rates have increased 1-3% (we now charge 11-14% annualized).

Origination fees (points) have increased 1-2 points as well (we charge 2-4 points).

Monthly extension fees have increased that protect our yields.

That combination has significantly boosted our annual yield (up 20-40% in our case).

And if that weren’t good enough… 1) we’re requiring that borrowers put more money down, and 2) our LTVs are lower than 2 years ago.

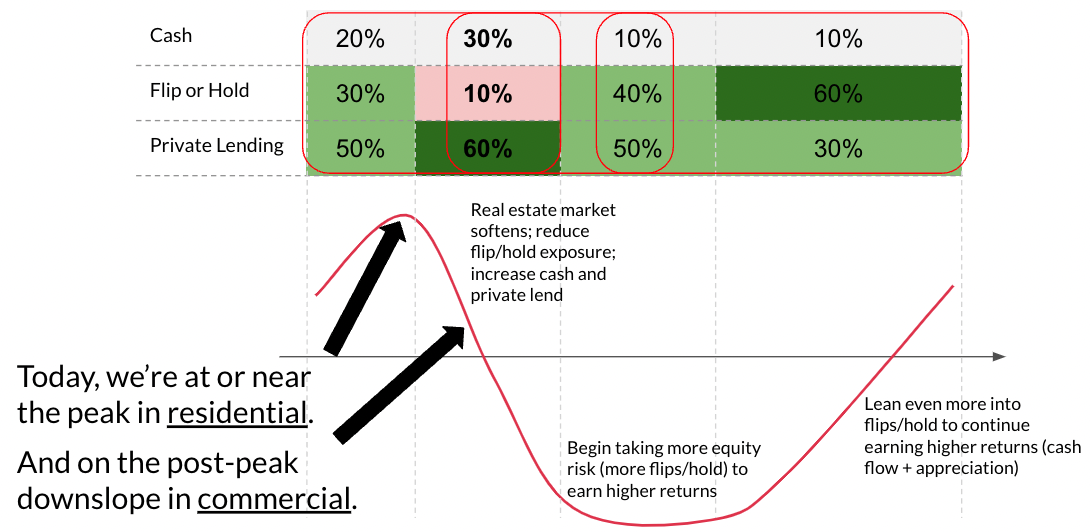

Let me bottom-line it for you: SMART real estate investors PIVOT throughout a market cycle to optimize risk-adjusted returns.

See the curving red line below? That represents a market cycle. As you’re climbing toward the peak, it makes sense to keep more of your money deployed; in this example, 80% of your investable capital is in the market (30% flips and 50% loans), and 20% is in cash.

After the peak, when asset values start falling, you want less of your money in the market. You want to reduce your exposure, especially your long-term exposure. You change your allocation so that it’s less exposed to downside; you increase your cash pile to 30%, and with the 70% you keep invested, you prioritize an “in-and-out” strategy like lending where your money is in the market for no more than 12 months.

Look, on the post-peak downslope, it simply does NOT make sense to buy real estate (to own it).

So what do you do when buying-to-own doesn’t make sense, but you still want to generate a positive after-inflation yield?

You control property rather than own it in order to protect against the downside of market depreciation, and you seek double-digit, recurring cash flow until an even greater investor opportunity presents itself. That’s always been my strategy.

You start — or you increase — short-term investing, i.e. like private lending. I promise your net worth will thank you.