The Money Game Mindset: Part 2 – Your Money Lens: Why Your Brain on Money Might Be Holding You Back

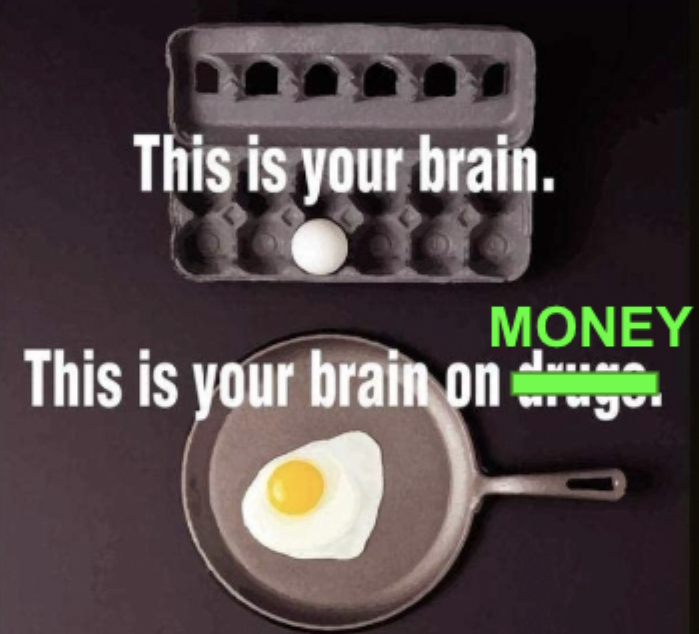

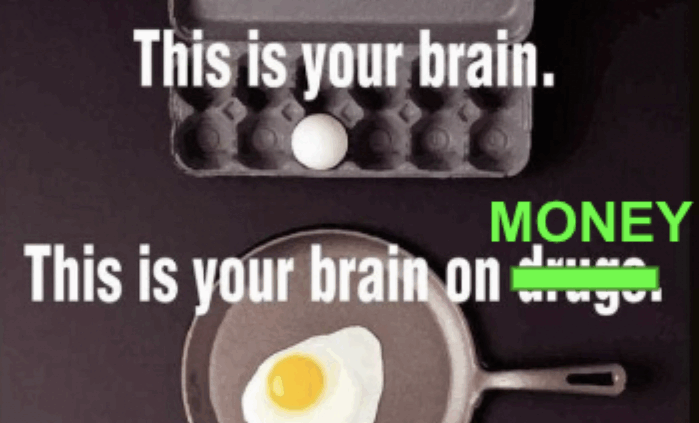

Remember that famous public service announcement from the ’80s and ’90s?

The one with the fried egg and the voiceover:

I can still see it perfectly. That ad was effective because it was sticky—you never forgot the message.

Here’s the twist:

This is also your brain on money.

It’s fried, scrambled, poached…the whole magilla.

Everyone Has a Money Lens (and It’s Warped)

We all view the world through a unique money lens—a personal filter for how we perceive earning, spending, saving, and investing. It’s a lot like a fingerprint:

- No two are exactly alike.

- You didn’t choose it (at least not in the beginning).

- It was shaped by circumstances outside your control.

Your early money lens was built by:

- The time period you were born into

- The place you grew up

- Your parents’ attitudes toward money

- The economic and financial events that shaped your childhood and young adulthood

Unlike a fingerprint, though, your money lens evolves—and it’s warped by your personal experiences.

Here’s the problem:

We vastly overestimate how representative our personal money experience is.

Just because you’ve seen money behave a certain way in your life doesn’t mean that’s how The Money Game actually works. That’s cognitive bias in action—our brains are egocentric by default.

Your Experience With Money Is Narrow

Think about this: has your financial life been anything like…

- A 19-year-old trust fund kid with a billion-dollar inheritance?

- A 90-year-old Hungarian who lived through 207% daily inflation in 1945, when prices doubled every 15 hours?

- A 26-year-old Vietnamese entrepreneur whose home country never experienced a recession?

- A 108-year-old seamstress who raised 11 kids in the Dust Bowl during the Great Depression?

Of course not.

Those are extreme examples, but they illustrate the point: your money lens is narrow, biased, and incomplete.

And until you recognize that bias, it will silently dictate your decisions.

A Warped Money Lens Leads to Bad Decisions

When your money lens doesn’t reflect how the Money Game really works, you end up making moves that hurt your net worth—sometimes without even realizing it.

Here are some of the classic mistakes I see:

- Chasing get-rich-quick schemes with your last savings

- Hoarding cash in a bank or under a mattress because it feels “safer” than investing

- Buying to impress instead of to grow: ever notice how apartment complex parking lots are full of luxury cars, while the modest homeowners down the street drive Toyotas?

It doesn’t stop there:

- “Spending money to make money” without a profit-first mindset—this kills countless businesses

- Teaching your kids “money doesn’t grow on trees”—true, but it reinforces scarcity over abundance

- Believing wealth is a zero-sum game—thinking rich people only get rich by exploiting the poor

- Avoiding all debt—credit card debt is bad, but strategic debt enables leverage and arbitrage, two essential wealth-building tools

All of these behaviors are symptoms of a fried money lens.

Your Money Lens Shapes Your Net Worth

Here’s the harsh truth:

Your current money lens is a huge predictor of your future net worth.

The data is sobering:

- The average American family has a net worth of $102,700

- By retirement age, the average net worth is $1.1M—but the median is only $200,000

- Translation: most people retire on less than $200K in total assets

No wonder most Americans can’t achieve true financial freedom.

Even more interesting? Your lens is influenced by education, geography, and homeownership:

- Some college attendees actually have lower median net worth than high school grads (college can create a false sense of financial security and debt dependence).

- Urban areas have wider gaps between median and average net worth—proof that the rich get disproportionately richer in cities.

- Homeowners almost always have higher net worth than renters because they’re leveraging assets instead of liabilities.

Your lens—your beliefs and biases—affects all of this.

How to “Un-Fry” Your Brain on Money

The first step is awareness.

You have to identify the ways your money lens is warped—and then consciously start reshaping it. The good news: unlike your fingerprint, your lens is malleable.

Here’s how to start:

- Reflect on your biases

- What beliefs about money did you inherit?

- Which of them no longer serve you?

- Observe your behaviors

- Where are you making “apartment lot Mercedes” moves instead of wealth-building moves?

- Upgrade your lens through exposure

- Learn how the wealthy really think and act

- Read, mentor, mastermind, and most importantly—implement

This is how you shift from a narrow, inherited money lens to a strategic, wealth-building lens that aligns with the actual rules of The Money Game.

Next up in Part 2, we’ll dive into Efforts Vs. Outcomes—why the way you think about effort can either trap you in the operator’s chair or catapult you into true wealth mastery.

Leave a Reply

Want to join the discussion?Feel free to contribute!