The Money Game Mindset: Part 1 – How Wealthy People Really Think About Money

By Dave Stech

Let’s start with a simple but uncomfortable truth:

Even after I got “wealthy,” I sometimes caught myself thinking—and acting—like a thousandaire.

Yep. Me.

Despite building significant wealth, my old “money lens” would pop up, and I’d find myself operating at a level below my actual net worth. Growing up poor will do that to you—it leaves some mental fingerprints that don’t go away on their own.

That’s why I built this Money Game Mindset series. Partly as a self-reminder to keep upgrading my thinking. And partly because I know I’m not the only one. If you’re honest with yourself, you’ve probably done it too.

Here’s the thing:

Whatever your current level of wealth—whether you’re an accredited investor, a multi-millionaire, or even a deca-millionaire—you can’t afford to think below your level. In fact, you’re best served by thinking at least one level above:

- If you’re a millionaire, think like a multi-millionaire.

- If you’re a deca, think like a centi.

- And if you’re not there yet, adopt the mindset now.

The gap between where your money is and where your mind is will determine how fast you grow—or how fast you shrink.

Why This Mindset Work Matters

Everyone reading this is already “successful.” You wouldn’t even be in my world otherwise. But within any mastermind or high-net-worth circle, there’s a spectrum:

- Some of you are just hitting your stride.

- Some are seasoned investors with war stories and wins.

- Some are in pure legacy mode, thinking about what the next generation inherits—not just in dollars, but in decision-making DNA.

I built this series for all of you.

If some concepts feel remedial, great—you’re ahead of the curve. If other concepts make you pause and rethink how you operate, even better. The goal is simple: one idea, one person, one shift that meaningfully moves the needle.

Here’s the bonus: Even if you’ve mastered these ideas, your kids haven’t.

This content isn’t just for you—it’s the foundation of your non-monetary legacy. If you want your wealth to outlive you, your family needs to think like wealth builders. That’s why I encourage you to share these lessons with your kids or grandkids. Because what you don’t learn and live, they will inherit—by default.

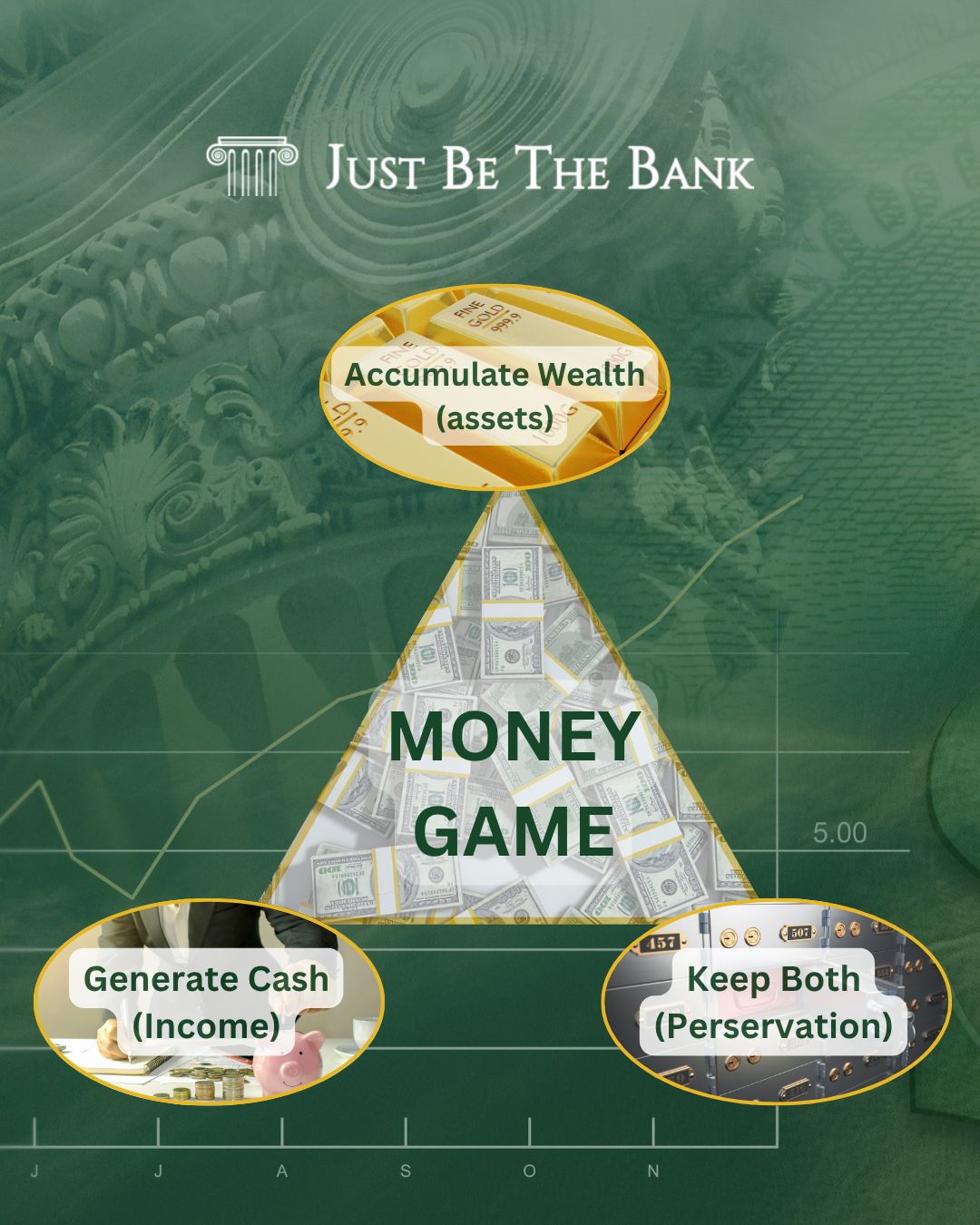

How Most Entrepreneurs Play the Money Game

Let’s take a look in the mirror.

Here’s the standard playbook I see over and over among high-performing entrepreneurs, professionals, and practice owners:

- Generate Cash / Income

- Your business or practice is the engine.

- It funds your lifestyle.

- Accumulate Wealth (aka Assets)

- You pay off and own your home, and perhaps the building your business operates out of.

- You grow traditional retirement accounts.

- You dabble in the stock market or maybe pick up some rental properties.

- Keep What You Can (Preservation)

- You reduce expenses (business and personal).

- You try to minimize taxes.

- You try not to lose money.

Play that game well, and you’ll earn a great lifestyle and eventually, freedom.

But…

This is just the default game. If you stop here, you’re playing checkers while true wealth-builders are playing chess.

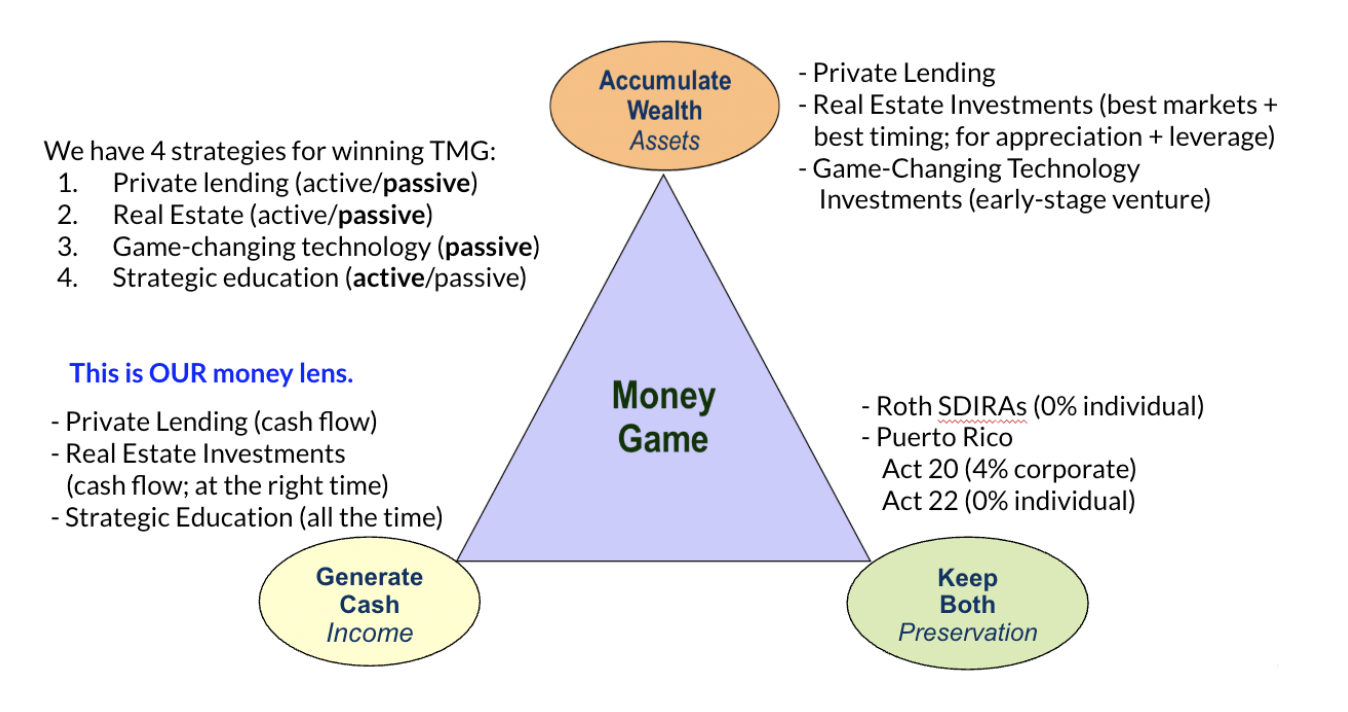

How My Family Plays the Money Game

For the Stech family, The Money Game never changes—only the strategies do.

Here’s our money lens:

- Generate Cash / Income

- Private Lending: cash flow, often with double-digit returns.

- Real Estate Investments: cash flow, at the right time.

- Strategic Education: all the time—because knowledge compounds like money.

- Keep and Grow (Preservation + Growth)

- Private Lending: Deployed in multiple structures for cash flow.

- Real Estate Investments: In the best markets and best timing for appreciation and leverage.

- Game-Changing Technology Investments: Early-stage venture plays that can 10x a slice of our portfolio.

- Tax-Advantaged Structures: Roth SDIRAs at 0% individual tax; Puerto Rico Act 60 at 4% corporate and 0% individual.

Our strategies flex with market cycles, but the gameboard stays the same:

Generate it. Keep it. Preserve it. Multiply it.

The Bottom Line for Part 1

You are already successful. But success without the right mindset is fragile. The wealth you’ve built—or are building—needs a mental upgrade to keep compounding.

And here’s the mindset shift I want to leave you with today:

Operate at least one level above your current net worth.

If you do this, you’ll accelerate freedom. You’ll protect your downside. And you’ll leave a financial and mental legacy your kids can inherit.

Next up in Part 2, we’ll dive into Your Money Lens—the unconscious ways you think about and perceive money—and how to upgrade it.

Leave a Reply

Want to join the discussion?Feel free to contribute!